Advanced mortgage calculator with extra payments

For example if you want to make an extra monthly payment of 100 during months 1-9 and an extra payment of 400 for months 7-36 you enter 100 for months 1-6. This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees.

Mortgage Payoff Calculator With Line Of Credit

Unfortunately I couldnt find such a calculator.

. Mortgage Calculator Excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether. Account for interest rates and break down payments in an easy to use amortization schedule.

For your convenience current Redmond mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions. Using our mortgage rate calculator with PMI taxes and insurance. Biweekly Mortgage Calculator with Extra Payments.

Extra payments count even after 5 or 7 years into the loan term. You can still boost your mortgage even if you make extra payments after a couple of years on your mortgage. If you own real estate and are considering making extra mortgage payments the early mortgage payoff calculator below could be helpful in determining how much youll need to pay and when to meet a certain financial goal.

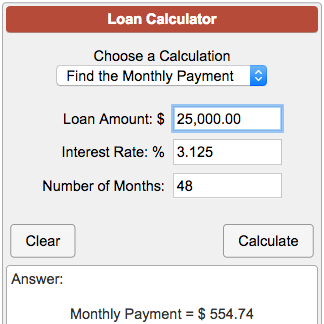

For Excel 2003. Home financial mortgage payoff calculator. Then once you have calculated the payment click on the Printable Loan Schedule button to create a printable report.

Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format. 2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low. The free mortgage calculator is a versatile tool as useful to an individual casually researching properties as it is to someone on the cusp of making a purchase.

30-Year Mortgages and Extra Payments. Divide the breakeven timeframe months by 12 to calculate the number of years you need to make payments on the loan before realizing any savings from the refinance. By using an advanced calculator you can see the savings in a matter of seconds and persuade yourself to bite the bullet and pay more every time you receive your car or mortgage loan statement.

Since creating this spreadsheet Ive created many other calculators that let you include extra mortgage paymentsThe most advanced and flexible one is my Home Mortgage Calculator. The monthly vs biweekly mortgage calculator will find out how much faster you can pay off your mortgage with biweekly payments and how much. Choose from 30-year fixed or 15-year fixed in the calculator.

The CUMIPMT function requires the Analysis. Even just an extra payment of 20 per month can make a. Since a bi-weekly plan results in 13 annual payments making that extra 13th payment can trigger the penalty.

The VA loan calculator provides 30-year fixed 15-year fixed and 5-year ARM loan programs. Especially with rates even the most minute change can have a big impact on your estimated mortgage payments. So I wanted to know what impact it would have on my mortgage if I make arbitrary extra payments.

Its popularity is due to low monthly payments and upfront costs. For example a 30-year fixed mortgage will have a lower monthly payment than a 15-year fixed but will require you to pay more interest over the life of the loan. Expensive penalty charges can dwarf any savings you make from bi-weekly payments.

Computes minimum interest-only and fully amortizing 30- 15- and 40-year payments. Your loan program can affect your interest rate and monthly payments. After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023.

A Roth IRA or a 401k before making extra mortgage payments. Ultimately significant principal reduction cuts years off your mortgage term. Another technique is to make mortgage payments every two weeks.

But as a self-employed person with variable income I find the steady nature of mortgage payments little hard to digest. Mortgage Payments on Adjustable-Rate Mortgages Without Negative Amortization. Advanced Option ARM Calculator with Minimum Payment Change Cap.

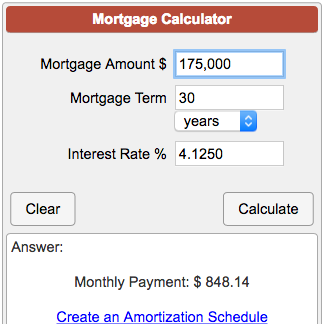

How to Use the Mortgage Calculator. Most homebuyers in America tend to obtain 30-year fixed-rate mortgagesAs of June 2020 the Urban Institute reports that 30-year fixed-rate loans account for 77 percent of new mortgages in the market. The loan program you choose can affect the interest rate and total monthly payment amount.

It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization. Also this calculator has the ability to add an extra amount extra payment to the monthly mortgage and turbo charge your interest savings. And with the house move came a brand new mortgage.

Calculate the difference in total interest paid on a mortgage loan when making additional monthly payments. Advantages Disadvantages of Biweekly Payments. Estimate how much youll pay each month for your new home with our easy-to-use mortgage calculator.

By making additional monthly payments you will be able to repay your loan much more quickly. Home price Down payment Down payment percent. If the first few years have passed its still better to keep making extra payments.

Recently we moved houses. This calculator will figure a loans payment amount at various payment intervals - based on the principal amount borrowed the length of the loan and the annual interest rate. Use a mortgage refinance calculator to determine the breakeven point which is the number of months it takes for the savings to outweigh the cost of refinancing.

The mortgage calculator spreadsheet has a mortgage amortization schedule that is printable and exportable to excel and pdf. Be sure to check with your home lender to make sure you can make extra payments on your mortgage without. This way they not only may enjoy higher returns but also benefit from.

With this unique 4 column format you can compare scenarios side-by-side print amortization schedules and plan your payoff strategy. This free online mortgage amortization calculator with extra payments will calculate the time and interest you will save if you make multiple one-time lump-sum weekly quarterly monthly andor annual extra payments on your house loan. You can edit this number in the advanced options.

The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete amortization schedules. Put simply its a standard mortgage calculator with extra payments built-in so its really easy to use. Use our free mortgage calculator to estimate your monthly mortgage payments.

It includes advanced features like amortization tables and the ability to calculate a loan including property taxes homeowners insurance property mortgage insurance. The calculator will not recognize overlapping payments of the same frequency. In addition to making extra payments another great way to save money is to lock-in historically low interest rates.

A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors.

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Advanced Loan Calculator

Extra Payment Mortgage Calculator For Excel

Loan Calculator With Payments On Sale 57 Off Www Wtashows Com

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Mortgage Monthly Payment Calculator Discount 55 Off Www Wtashows Com

Loan Calculator With Payments On Sale 57 Off Www Wtashows Com

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Extra Payment Calculator Is It The Right Thing To Do

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Best Mortgage Calculator App For Android

Mortgage With Extra Payments Calculator

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Mortgage Calculator Apps On Google Play